Trump Administration Explores Oil Companies" Interest in Venezuela Post-Maduro

In a recent development, the Trump administration has reached out to U.S. oil companies to gauge their interest in returning to Venezuela, contingent upon the potential ousting of President Nicolás Maduro. Sources familiar with the discussions indicate that the response from these companies has been overwhelmingly negative, with a firm “no” regarding any immediate plans to re-enter the Venezuelan market.

Key Details

The outreach from the Trump administration marks a significant indication of its aspirations for a post-Maduro Venezuela, reflecting a broader strategy that intertwines U.S. foreign policy with the dynamics of global oil markets. As of Wednesday afternoon, December 17, 2025, the U.S. benchmark oil price stood at approximately $56 per barrel, the lowest level recorded since January 2021. This pricing context suggests that the administration may have limited concerns about the economic repercussions of military action in Venezuela, particularly regarding gasoline prices in the U.S.

Despite the administration"s interest, U.S. oil companies are currently prioritizing investments in other regions, where they perceive better opportunities for returns. Major oil corporations including Chevron, ExxonMobil, ConocoPhillips, Halliburton, Schlumberger, Weatherford International, and Baker Hughes were actively involved in Venezuela during the early 2000s. At that time, the Venezuelan government, under then-President Hugo Chávez, attempted to force these companies to relinquish majority stakes in their projects to the state-owned Petróleos de Venezuela (PDVSA). Companies that resisted faced asset seizures, a move that has left a lasting impact on the willingness of U.S. firms to engage with Venezuela’s oil sector.

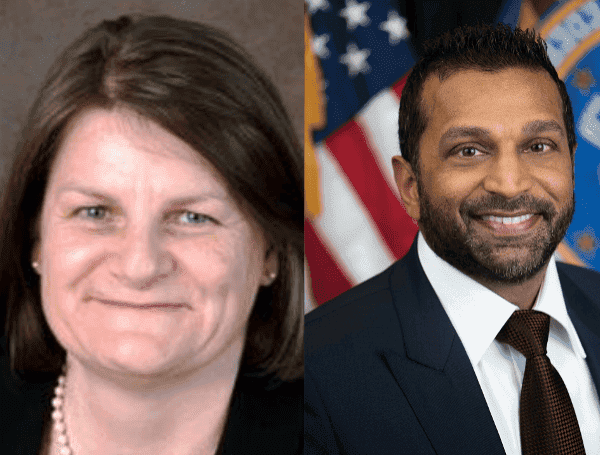

Image for Trump administration asks U.S. oil companies about returning to Venezuela

Background

The current political climate in Venezuela remains tense, with Nicolás Maduro facing ongoing opposition and calls for his resignation. The U.S. has long been critical of Maduro"s government, which it accuses of authoritarian practices and human rights violations. The potential for a regime change in Venezuela has sparked discussions about the future of its vast oil reserves, which are among the largest in the world. However, the historical context of U.S. oil companies" experiences in Venezuela complicates the prospect of their return.

Moreover, the current low oil prices may influence the decision-making process for these companies. With prices hovering around $56 per barrel, the financial incentive to invest in a politically unstable environment like Venezuela is diminished. This economic backdrop suggests that U.S. oil companies are likely to continue exploring opportunities in more stable regions where they can secure better returns on their investments.

What"s Next

The Trump administration"s outreach to oil companies signals a strategic interest in reshaping U.S.-Venezuela relations, particularly in the energy sector. However, the firm rejection from major oil companies indicates significant barriers to re-engagement. As the political situation in Venezuela evolves, the administration may need to reassess its approach to attract U.S. investment in the country’s oil industry. The interplay between U.S. foreign policy, oil market dynamics, and the future of Venezuela"s leadership will be critical factors to watch in the coming months.

For further context on related political developments, see our recent coverage on the implications of high-profile political figures in the current landscape.

Image for Trump administration asks U.S. oil companies about returning to Venezuela

![[Video] FBI links MIT Nuclear Scientist murder to Brown University shooter in Lisbon](/_next/image?url=%2Fapi%2Fimage%2Fthumbnails%2Fthumbnail-1766114460322-f0219la-thumbnail.jpg&w=3840&q=75)

![[Video] Providence Police Chief: Claudio Valente acted alone, no antisemitism involved](/_next/image?url=%2Fapi%2Fimage%2Fthumbnails%2Fthumbnail-1766113851389-coopcb-thumbnail.jpg&w=3840&q=75)

![[Video] Brown University suspect identified as Claudio Manuel Neves-Valente, 48](/_next/image?url=%2Fapi%2Fimage%2Fthumbnails%2Fthumbnail-1766112697009-8f53bc-thumbnail.jpg&w=3840&q=75)