China Imports 13.6% of Oil from Iran in First Half of 2025

Author: Dr. Sarah Chen

Date: January 12, 2026

In a significant development in global energy markets, China has emerged as the primary purchaser of oil from Iran, with Iranian crude oil accounting for approximately 13.6 percent of China"s total oil imports during the first half of 2025. This trend underscores China"s increasing dependence on Iranian oil amidst ongoing geopolitical tensions and sanctions affecting Iran"s energy sector.

Key Details

According to data from Kpler, a leading provider of oil market intelligence, China imported an average of around 1.38 million barrels per day (bpd) of Iranian crude oil in the first half of 2025. This figure represents a staggering 90 percent of the total oil shipped from Iran, highlighting China"s pivotal role in sustaining Iran"s oil export economy.

Despite the stringent sanctions imposed on Iran"s energy sector by various countries, including the United States, Iranian crude has continued to attract Chinese buyers. The primary factor driving this demand is the significant price discount offered by Iran, with rates ranging from $7 to $8 per barrel below global benchmarks. This pricing strategy has made Iranian oil an appealing option for Chinese importers, who are looking to secure energy supplies at lower costs.

Similar to the situation with Russian oil, Iran"s ability to offer discounted energy is largely due to the complexities involved in buying and transporting the fuel under current geopolitical conditions. These challenges have created a unique market dynamic where buyers like China can capitalize on lower prices while supporting Iran"s economy.

Background

The relationship between China and Iran has been shaped by a series of geopolitical events and economic strategies. China"s growing energy needs, driven by its rapid industrialization and urbanization, have led the country to seek reliable sources of oil. Meanwhile, Iran, facing economic isolation due to international sanctions, has turned to China as a critical market for its oil exports.

In recent years, the U.S. has implemented various sanctions aimed at curbing Iran"s oil exports, including a 25% tariff on countries doing business with Iran, as previously reported. These sanctions have not only affected Iran"s economy but have also prompted it to seek alternative markets, with China emerging as a key partner in this regard.

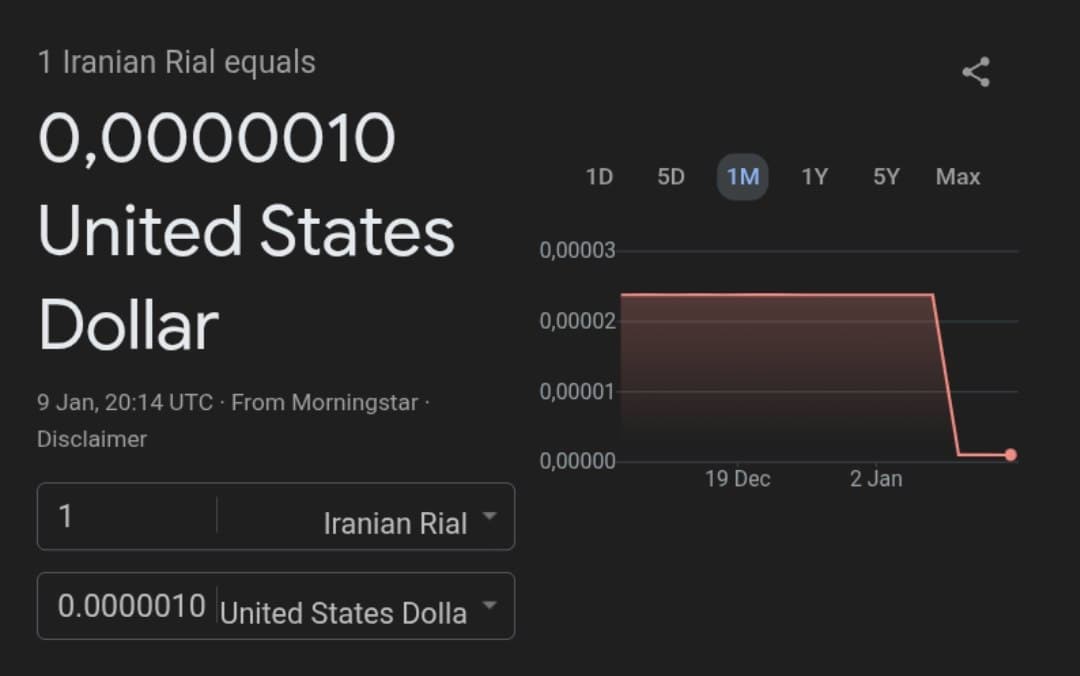

Image for China imports 13.6% of oil from Iran in first half of 2025

What"s Next

The implications of China"s heavy reliance on Iranian oil imports are multifaceted. For Iran, this relationship provides a vital lifeline amid economic sanctions, allowing it to maintain a degree of financial stability. For China, securing a steady supply of oil from Iran is crucial for its energy security, especially as it continues to navigate a complex global energy landscape.

As the geopolitical situation evolves, the dynamics of oil imports between China and Iran will likely continue to shift. Observers will be closely monitoring how these developments impact global oil prices and the broader energy market. The ongoing reliance on discounted Iranian crude could also influence China"s relationships with other oil-producing nations and its overall energy strategy moving forward.

For more on related coverage, see previous reports regarding U.S. tariffs affecting international oil trade.

![[Video] Anti-ICE Protester Pepper Sprayed as CBP Agents Disperse Crowd in Minneapolis](/_next/image?url=%2Fapi%2Fimage%2Fthumbnails%2Fthumbnail-1768260677127-y71sb7-thumbnail.jpg&w=3840&q=75)

![[Video] Minneapolis Mayor Jacob Frey calls DHS agents' arrival an 'INVASION'](/_next/image?url=%2Fapi%2Fimage%2Fthumbnails%2Fthumbnail-1768258260467-z8ar1h-thumbnail.jpg&w=3840&q=75)