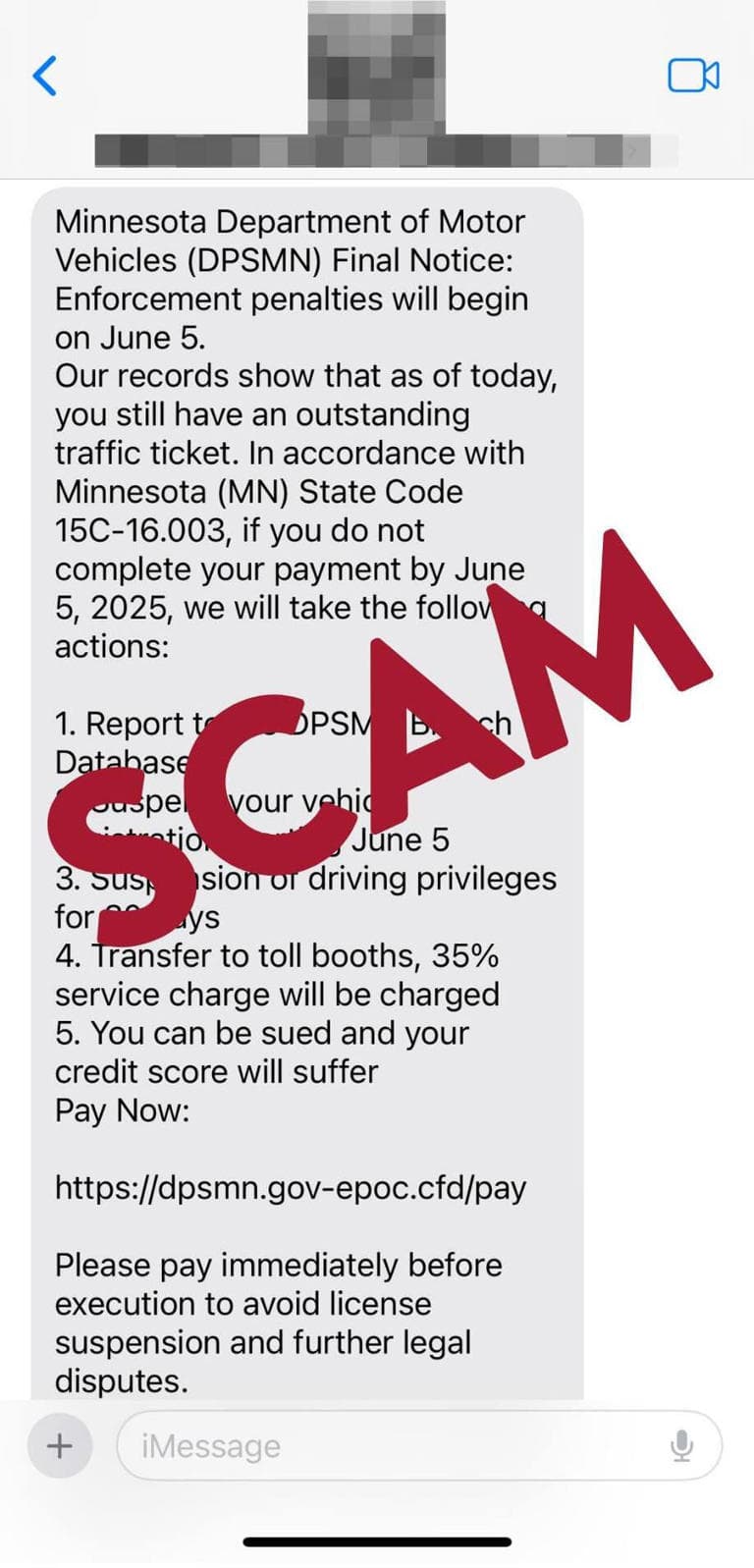

Thousands of Americans have announced their intention to refuse to pay taxes this year following revelations of large-scale scams in Minnesota. The announcement comes amidst growing concerns over the integrity of tax collection and the impact of fraudulent activities on taxpayers.

The situation has drawn significant attention, leading to discussions about the implications for tax compliance across the country. As previously reported, similar situations have arisen in various contexts, prompting public outcry and calls for reform.

As the deadline for tax payments approaches, the response from taxpayers highlights a significant shift in attitudes towards tax obligations in light of these recent developments. Authorities are expected to address the concerns raised by citizens regarding the scams and their effects on the tax system.

This refusal to pay taxes could have broader implications for government revenue and public services. The situation continues to evolve as more individuals express their dissatisfaction with the current state of tax enforcement and protection against fraud.

Image for Thousands of Americans refuse to pay taxes after Minnesota scams

For more information on related coverage, see recent developments in political ethics and accountability.