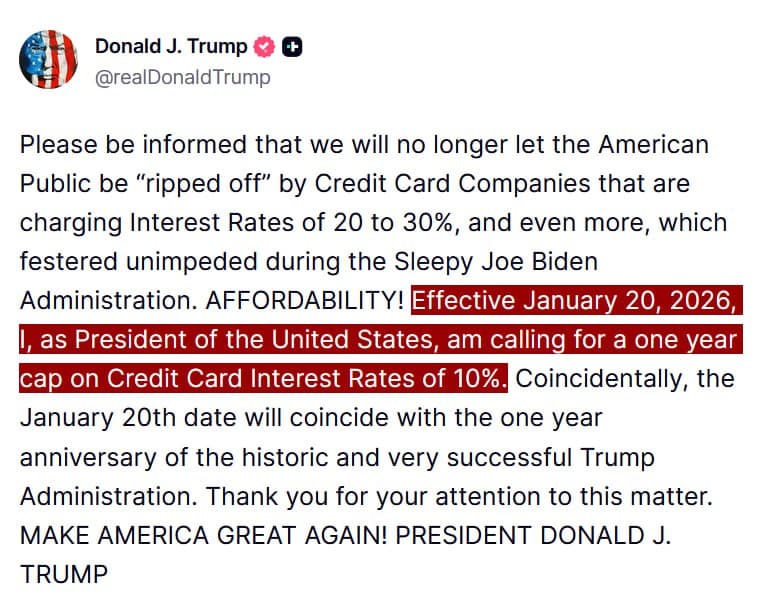

Former President Donald Trump has proposed a one-year cap on credit card interest rates, suggesting a maximum rate of 10%. This cap is set to take effect on January 20, 2026.

Trump"s announcement comes as part of his ongoing discussions regarding economic policies and consumer protections. The proposed measure aims to address concerns over high-interest rates charged by credit card companies.

This proposal follows a series of recent developments in various political and economic matters, including the suspension of federal funding to Minnesota over a fraud investigation. Such actions highlight the ongoing scrutiny of financial practices and regulations in the United States.

As the date approaches for the proposed cap, further discussions and reactions from lawmakers and financial institutions are anticipated.

![[Video] Netanyahu: Israel aims to end reliance on U.S. military aid in a decade](/_next/image?url=%2Fapi%2Fimage%2Fthumbnails%2Fthumbnail-1767983462253-efb0o5-thumbnail.jpg&w=3840&q=75)